A report, Government Subsidies to Homeowners versus Renters in Ontario and Canada, by housing economist Frank Clayton, estimates the size of the imbalance in the way that owners and renters are treated by Canada’s various housing subsidy programs. Housing-related subsidies include both direct budgetary expenditures and tax benefits (commonly referred to as tax expenditures).

When any household seeks a place to live there are two basic starting decisions: to own (buy a house or condo), or rent. Canada’s small social housing sector, about 5% of all housing, means that 95% of Canadian households must seek housing in the private sector – either buy a house or condo, or rent from the private rental sector.

A housing system ought to be neutral in terms of subsidies provided to owners and renters. Why should one form of housing tenure be more subsidized, and thereby favoured, than the other? Many households have no choice but to rent because they do not have a down payment and/or do not qualify for a mortgage (their income is too low; their job is not secure enough, etc.).

The report estimates the size of the imbalance in the way that owners and renters are treated. It carefully documents the magnitude of each of the subsidies provided by the federal government, the Ontario government, and municipalities in Ontario to homeowners and private renters.

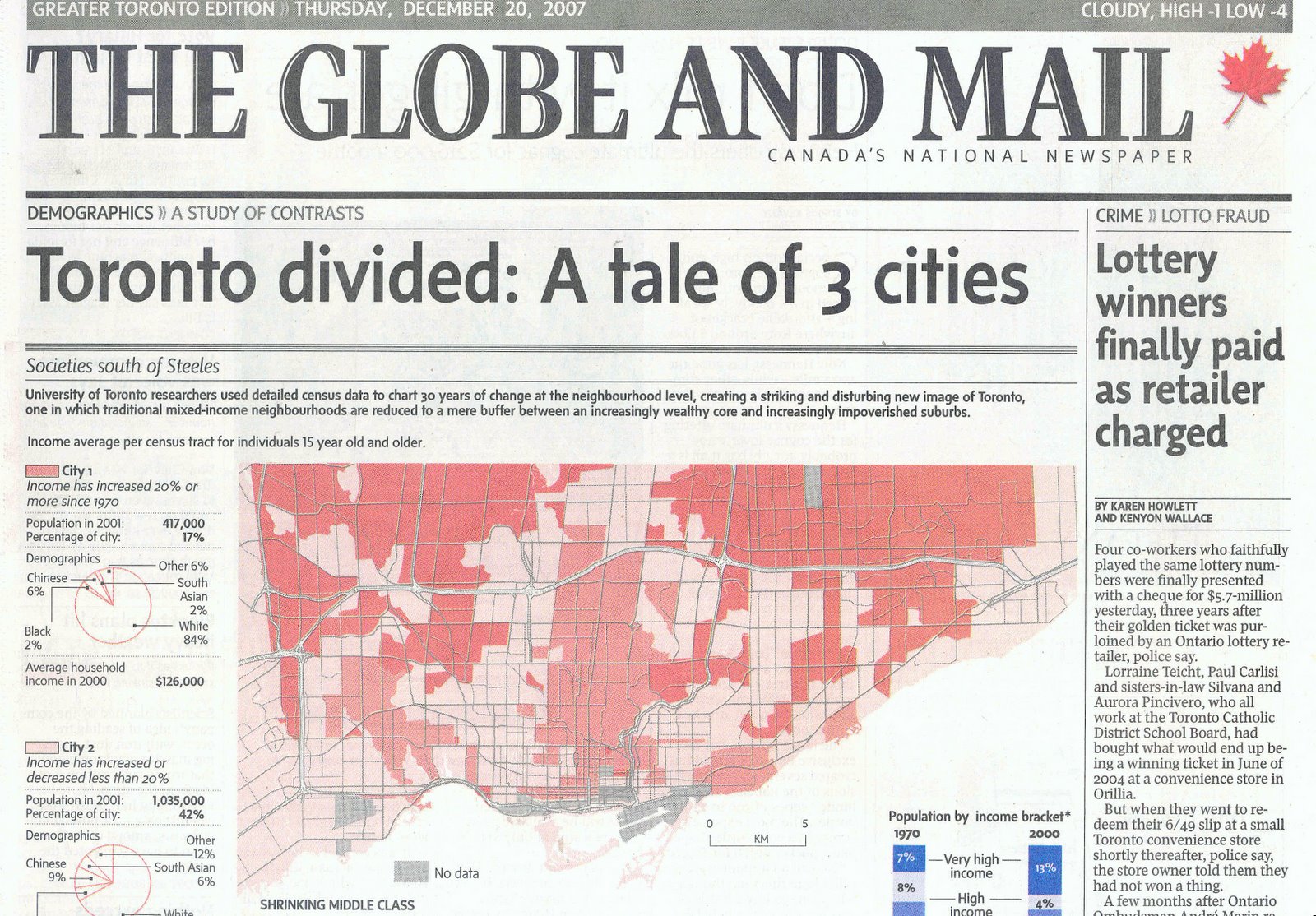

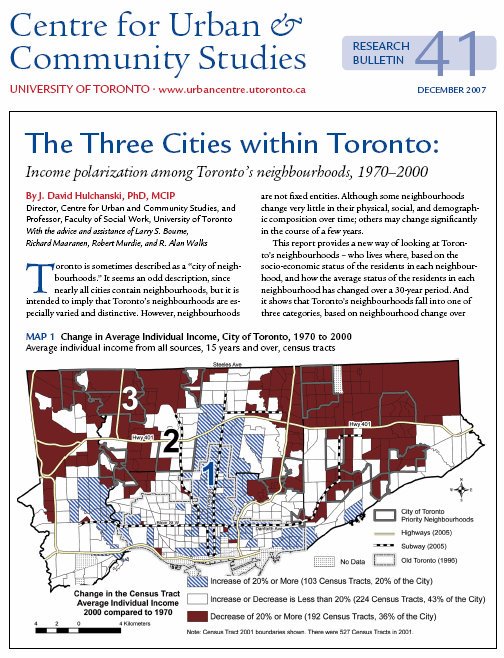

In terms of the $8.9 billion of total annual housing-related subsidies for both owners and private renters in Ontario in 2008/09 the federal government providedthe largest share , $6.6 billion or 73.7%, followed by the Province of Ontario, $1.7 billion or 18.5%, and municipalities, $697 million or 7.8%. Most of this taxpayer money, 93.7% (or $8.4 billion) went to homeowners while the remaining 6.3% (or $562 million) assisted renters in the private rental sector. This is, on average, an annual $2,629 subsidy per Ontario homeowner.

For Canada total federal spending for homeowners and private renters was $17.1 billion in 2008/09, 92.6% (or $15.8 billion) assisted homeowners while the remaining 7.4% (or $1.3 billion) went to private renters. Owners received an average of $1,823 in subsidies per household while private renters received an average of $308 per household.

“The split in subsidies by tenure,” Clayton notes, “is the reverse of the disparity in income – the largest portion of subsidies went to households with the highest average incomes in 2008/09.” Homeowners have average incomes that are double those of renters. In Ontario, for example, the 2008 average household income for homeowners was $93,000 while the average household income of private renters was $45,500. For Canada: $91,000 and $44,000.

Why should homeowners receive about six times the annual subsidy that renters receive? We have no answer from any level of government. The system of private sector housing-related subsidies evolved over time and reflects a cultural and political bias in favour of owners.

What about social housing?

These ownership and private rental housing subsidies are separate from the category of subsidies that support non-market social housing (public housing, non-profit housing, and non-profit co-operatives). Social housing is targeted at lower income households who cannot, or have difficulty, accessing and affording housing in the private sector.

Given the approximately $17 billion in annual federal government subsidies for homeowners and private renters, how much does the federal government allocate to social housing – helping lower income households in need, households who cannot own or access private sector renting? It is just under $2 billion. This is the subsidy bill for all federal government assisted social housing ever built in Canada – the approximately 5% of Canada’s housing stock that is not market housing (about 550,000 units).

All these expenditure figures come from the report by Frank Clayton which includes a detailed appendix that provides a great deal of helpful information about each individual housing spending program and each tax expenditure provision. The study was commissioned by the Federation of Rental-Housing Providers of Ontario and the Canadian Federation of Apartment Associations.

Clayton provides two conclusions:

· “Housing subsidies in Ontario and Canada encompassing both direct spending programs and tax expenditure provisions massively favour private homeowners over private renters; and

· “This favouritism to homeowners occurs even though private renters on average have household incomes about one-half the average income of homeowners.”This report is important in the context of the nation’s aging rental housing stock and the fact that very little new rental housing, market or non-market, is being built.

This is not a new problem, but it is the most serious and the most ignored housing problem the country faces. What the report demonstrates is that there is no such thing as a pure private sector in housing. The one housing tenure that ought to be able to stand on its own, ownership housing, is the most heavily subsidized.

There is nothing wrong with supporting the home ownership sector. The approximately 65% of Canadian households that own their own home know that the system works reasonable well for them.

What homeowners generally do not know is the subsidy information provided in the Clayton report. Government plays a major role in not only subsidizing ownership housing but maintaining a stable mortgage system, including public sector mortgage insurance. Mortgage insurance enables many to become homeowners earlier (i.e., they do not need a 25% down payment to get a mortgage if they insure their mortgage against default via the Canada Mortgage and Housing Corporations mortgage insurance program.

It is not uncommon to hear complaints from many voters, including homeowners, that they do not support housing subsidies – a reference to social housing subsidies – not knowing they are the major beneficiary of housing subsidies.

The difficulties in Canada’s private rental sector are not limited to the lack of subsides for renters relative to home owners. It is also the termination in 1984 of direct subsidies for the construction of new rental housing.

From the late 1940s to the 1984 decision by the Mulroney government to terminate private sector rental supply subsidies, most private sector rental housing was built with government subsidies: the limited-dividend program, 1940s to 1970s; the Assisted Rental Program, mid-1970s; the MURB (multiple unit residential building) tax shelter program, late 1970s; and the Canada Rental Supply Program, early 1980s.

Given that renters have on average half the income of homeowners private sector rental housing cannot be built profitably nor do many tenants have enough money to support the rents that would be required to fully upgrade the aging rental stock they live in.

A range of public financial support, direct spending and tax expenditures, for both private and social rental housing and its residents is required. There is no choice. It is provided for homeowners but not or renters.